Changes how DRS sales are handled on RetailConnect

Connections in Cloud | Applicable to: ROI only

The following applies to ROI clients only who deal with DRS on their EPoS system. The below covers CBE and Retail Solutions EPoS providers.

DRS is handled as a separate transaction type. As from 9th February you probably already see this line appearing on the cash book. However before posting to Sage you need to map this transaction type to a nominal on your balance sheet e.g. DRS Control A/C.

Process:

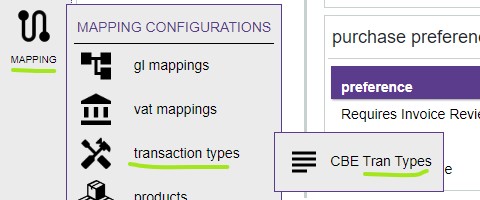

1. Go to MAPPING – TRANSACTION TYPES – EPoS Dept Map (e.g. RS Dept Map)

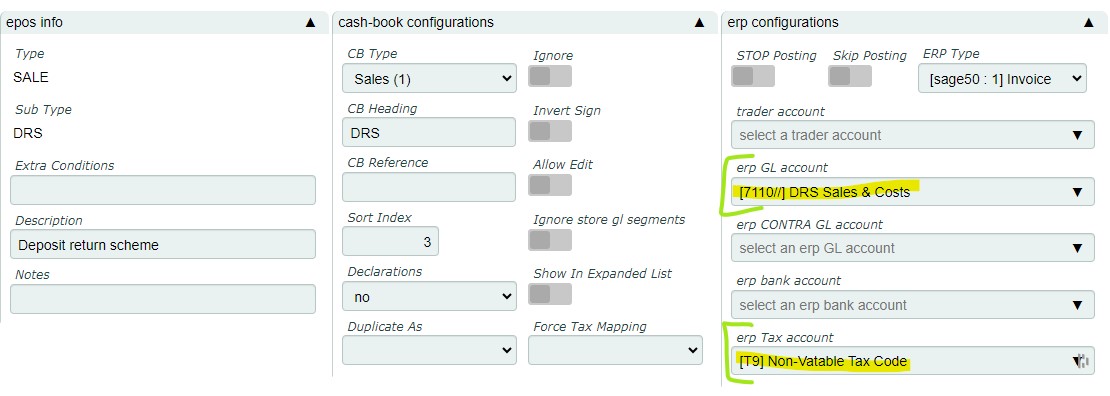

2. Find the DRS transaction types – there should be two different types here. One for DRS sales and one for DRS refunds.

CBE: SALE / DRS

Retail Solutions: 101.0 / 101.99

And click the edit option.

3. Select the GL code (nominal code) in the erp GL account field. And make sure correct VAT code specified in erp Tax Account field.

4. Click Save and now you can go back to your cash books and post the day to sales.

NOTE:

In case the DRS line is not showing on or after 1st February 2024 (and there were DRS sales on EPoS); delete the day and let it import again.

PAYOUTS

Payouts are handled differently on each EPoS provider. Also you might have an integrated RVM or doing manual payouts on the till.

If manual payouts are used these will show as UNKNOWN or NEEDS MAPPED. Please let us know when that happens and we cnanhelp you to add this transaction type.